“Compare Libra Coin and Bitcoin: Discover their technology, use cases, adoption, and how they differ in decentralization, regulation, and market potential.”

Table of Contents

Introduction

“Libra Coin and Bit-coin are two prominent digital currencies, each with distinct characteristics and goals. While Bit-coin pioneered decentralized cryptocurrency with a focus on financial freedom, LibraCoin (now rebranded as Diem) aims to provide a stable and globally accessible digital currency backed by a basket of assets. In this comparison, we’ll explore their underlying technologies, use cases, market potential, and the differences in their approach to regulation and adoption.”

Libra Coin vs Bitcoin: A Comparison of Two Digital Currencies

In the evolving world of digital currencies, two names stand out — Bit-coin and LibraCoin (now rebranded as Diem). While both aim to revolutionize financial transactions, they each have distinct goals, technologies, and market strategies. In this article, we’ll delve into the differences and similarities between these two cryptocurrencies and explore what each brings to the table for the future of digital finance.

1. Introduction to Bitcoin and Libra Coin (Diem)

Bit-coin was launched in 2009 by an anonymous entity known as Satoshi Nakamoto and quickly became the first decentralized cryptocurrency to gain widespread recognition. Operating on blockchain technology, Bit-coin allows peer-to-peer transactions without the need for an intermediary, offering transparency and financial freedom. Bit-coin’s primary appeal lies in its decentralized nature, scarcity (only 21 million coins ever), and potential as a store of value or “digital gold.”

On the other hand, LibraCoin, which was initially proposed by Facebook (now Meta) in 2019, aims to create a global, stable digital currency. With its backing by a basket of fiat currencies and other assets, the goal of LibraCoin was to address the volatility issues seen with other cryptocurrencies. However, due to regulatory concerns, the project was rebranded as Diem in 2020. Diem’s focus is to create a regulated, stablecoin-backed digital currency for everyday transactions, designed to be used by businesses and consumers alike.

2. Underlying Technology

The technology behind Bit-coin and Libra Coin (Diem) differs significantly.

- Bit-coin is powered by a public, permissionless blockchain. Every transaction made with Bit-coin is recorded on this blockchain and verified by a decentralized network of miners, making the currency resistant to censorship. The proof-of-work (PoW) consensus mechanism Bitcoin uses is energy-intensive but provides strong security against fraud.

- LibraCoin (Diem), however, is based on a permissioned blockchain. This means that transactions are validated by a consortium of trusted organizations, such as banks and financial institutions. The currency is designed to be stable, with the value pegged to a basket of fiat currencies and government-backed assets, unlike Bit-coin, which is subject to high volatility.

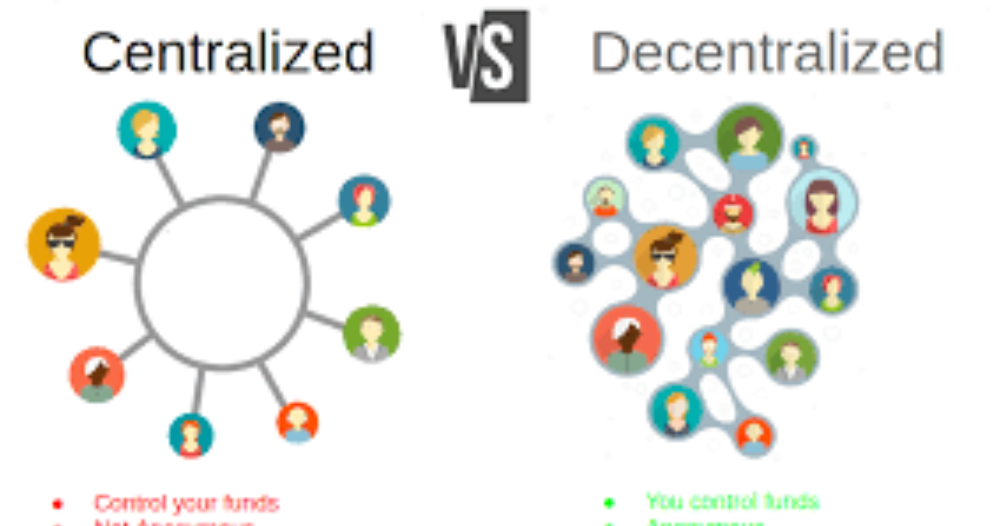

3. Decentralization vs. Centralization

One of the most fundamental differences between the two digital currencies lies in their level of decentralization.

- Bit-coin prides itself on decentralization. No single entity controls the Bit-coin network, and it is governed by a protocol maintained by a global community of miners and developers. This structure ensures that Bit-coin remains immune to government or institutional control, providing financial freedom to its users.

- LibraCoin (Diem), in contrast, is built on a centralized structure. Though it was initially designed to be decentralized by involving multiple organizations, the nature of its permissioned blockchain means that power is largely in the hands of a consortium of companies and institutions. This could limit its appeal for users who value financial privacy and autonomy.

4. Use Cases and Adoption

Bit-coin’s primary use case is as a store of value and a medium of exchange. Its limited supply (only 21 million coins) has led to its characterization as “digital gold,” and it is increasingly seen as a hedge against inflation and economic instability. Over the years, Bit-coin has gained acceptance among investors, institutions, and even governments. It’s used for a variety of purposes, including:

- Peer-to-peer transactions

- Investment and speculation

- International remittances

- As a hedge against inflation

In comparison, LibraCoin (Diem) was designed with a more consumer-centric use case in mind. Its focus is on providing a stablecoin that can facilitate everyday transactions, particularly for those who are underserved by traditional banking systems. Diem’s aim is to integrate seamlessly into global commerce, providing an accessible and stable digital currency for people to use on platforms like Facebook, WhatsApp, and Instagram.

5. Regulation and Government Involvement

Bit-coin operates in a gray regulatory area in many countries. Some governments embrace it, seeing it as a technological innovation, while others impose restrictions due to concerns about its use in illegal activities. Bit-coin’s decentralized nature complicates regulation, as no single authority can enforce rules or compliance.

In contrast, LibraCoin (Diem) was designed with regulation in mind from the start. When Facebook first introduced Libra, it was met with significant backlash from regulators across the world. The company adjusted its plans and ultimately rebranded the project to Diem, aiming to work within regulatory frameworks. Diem seeks to operate under the oversight of regulatory bodies, offering a more compliant and centralized approach to digital currency adoption.

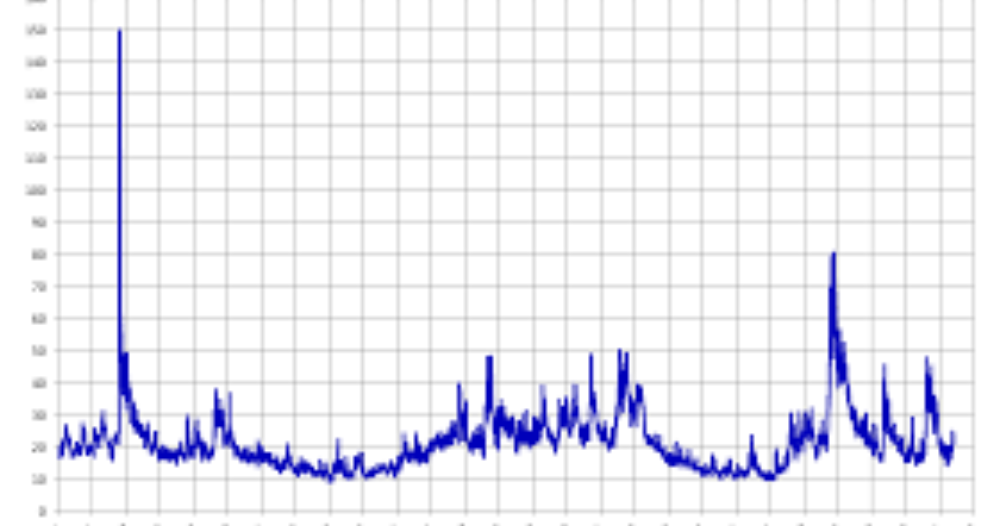

6. Stability vs. Volatility

One of the primary concerns with Bit-coin is its volatility. Bit-coin’s price can swing dramatically, which has both benefits and risks. While some see it as an opportunity for high returns, others find its fluctuations to be a barrier for adoption as a daily-use currency.

Libra Coin (Diem), in contrast, seeks to solve this problem with its stablecoin model. By being pegged to a basket of assets, it is designed to offer more price stability, making it more suitable for everyday transactions. This stability could encourage adoption by businesses and consumers alike, as it removes the risk of price swings associated with Bit-coin.

7. The Future of Bit-coin vs Libra Coin

While both Bitcoin and LibraCoin (Diem) are paving the way for a new era of digital currency, their futures are shaped by different factors:

- Bitcoin’s future remains uncertain but promising. Its status as the first cryptocurrency and its established use cases position it as a long-term digital asset with strong growth potential. The growth of institutional adoption, Bitcoin ETFs, and its appeal as a store of value suggest that Bitcoin’s role in the global financial system will continue to expand.

- LibraCoin (Diem), on the other hand, is still in its early stages. The stability of the Diem coin, coupled with the backing of major corporations and global entities, could eventually lead to widespread adoption, especially in regions where stable and accessible financial systems are lacking. However, regulatory challenges and the project’s ties to Meta (formerly Facebook) may limit its acceptance among users who are wary of centralized control.

Conclusion

In conclusion, both Bitcoin and LibraCoin (Diem) represent significant innovations in the world of digital currency, but their philosophies and approaches differ. Bitcoin remains the leader in decentralization, offering freedom and potential for investment, while LibraCoin (Diem) aims to provide stability and accessibility for everyday transactions. As the digital currency space evolves, the success of each will depend on their ability to overcome challenges, whether regulatory, technological, or economic.

Both digital currencies are shaping the future of finance, but in very different ways. Whether you’re drawn to Bitcoin’s decentralized nature or Diem’s stability and practicality, these cryptocurrencies are key players in the ongoing transformation of the global financial system.

FAQs About libra coin vs bitcoin

What is Bitcoin?

Bitcoin is the first decentralized digital currency, launched in 2009 by an anonymous entity named Satoshi Nakamoto. It operates on a peer-to-peer network without the need for intermediaries like banks.

What is Libra Coin (Diem)?

LibraCoin, rebranded as Diem, was initially proposed by Facebook in 2019 to create a stable digital currency backed by a basket of fiat currencies and assets. Its goal is to provide a stable, global currency for transactions.

How does Bitcoin work?

Bitcoin operates on a decentralized blockchain. Transactions are verified by miners using the proof-of-work mechanism, ensuring transparency and security without the need for a central authority.

What is the main use case for Bitcoin?

Bitcoin is primarily used as a store of value (digital gold), an investment vehicle, and a medium for peer-to-peer transactions, particularly in places where traditional financial systems are limited.

What is the main use case for Bitcoin?

Bitcoin is primarily used as a store of value (digital gold), an investment vehicle, and a medium for peer-to-peer transactions, particularly in places where traditional financial systems are limited.

What is the main goal of Libra Coin (Diem)?

Diem’s main goal is to create a stable digital currency for global transactions, making it easy for businesses and consumers to use digital money in everyday exchanges, especially in regions with less access to traditional banking.

Can Bitcoin be used for everyday purchases?

Yes, Bitcoin can be used for everyday purchases at businesses that accept it as a form of payment. However, its price volatility can make it less practical for daily transactions compared to stablecoins like Diem.

What backs the value of Bitcoin?

Bitcoin’s value is backed by its limited supply (only 21 million coins), its decentralized network, and the trust placed in its security and usability by users, investors, and developers.

What backs the value of Libra Coin (Diem)?

Libra Coin (Diem) is pegged to a basket of stable assets, such as government-backed fiat currencies, to maintain price stability and avoid the volatility seen in other cryptocurrencies like Bitcoin.

Is Bitcoin decentralized?

Yes, Bitcoin is completely decentralized. It operates on a public ledger (the blockchain), which is verified by a distributed network of nodes, meaning no central authority or government controls it.

Is Libra Coin (Diem) decentralized?

No, Libra Coin (Diem) is not decentralized. It operates on a permissioned blockchain with governance from a consortium of companies and financial institutions.

How do I buy Bitcoin?

You can buy Bitcoin through cryptocurrency exchanges like Coinbase, Binance, or Kraken using traditional fiat currencies or other cryptocurrencies. Wallets like Ledger or Trezor can store your Bitcoin securely.

How do I buy Libra Coin (Diem)?

Diem (formerly Libra Coin) is still in development and has not yet launched for direct purchase by the public. However, once available, it will be integrated into various platforms like Facebook and WhatsApp for easier accessibility.

What are the risks associated with Bitcoin?

Bitcoin’s risks include price volatility, security threats like hacking, regulatory uncertainties, and the potential for losing access to wallets if the private keys are lost.

What are the risks associated with Libra Coin (Diem)?

Diem faces regulatory scrutiny due to its connection with Facebook (Meta) and its centralization. Additionally, the reliance on a stablecoin model could limit its adoption in countries with strong currency control policies.

By : Coinfxnews